Market coverage

- Austria

- Germany

- Global

- Switzerland

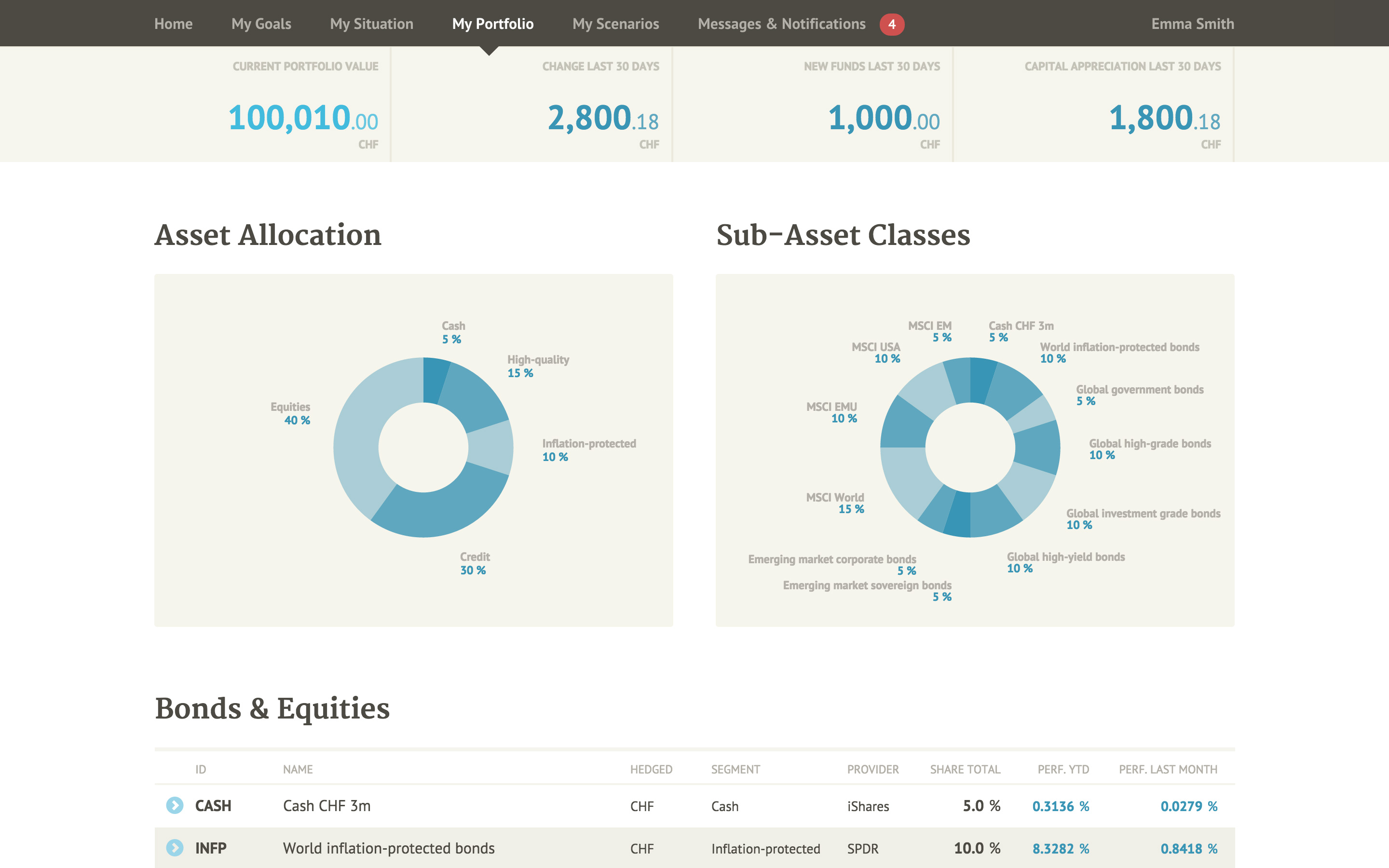

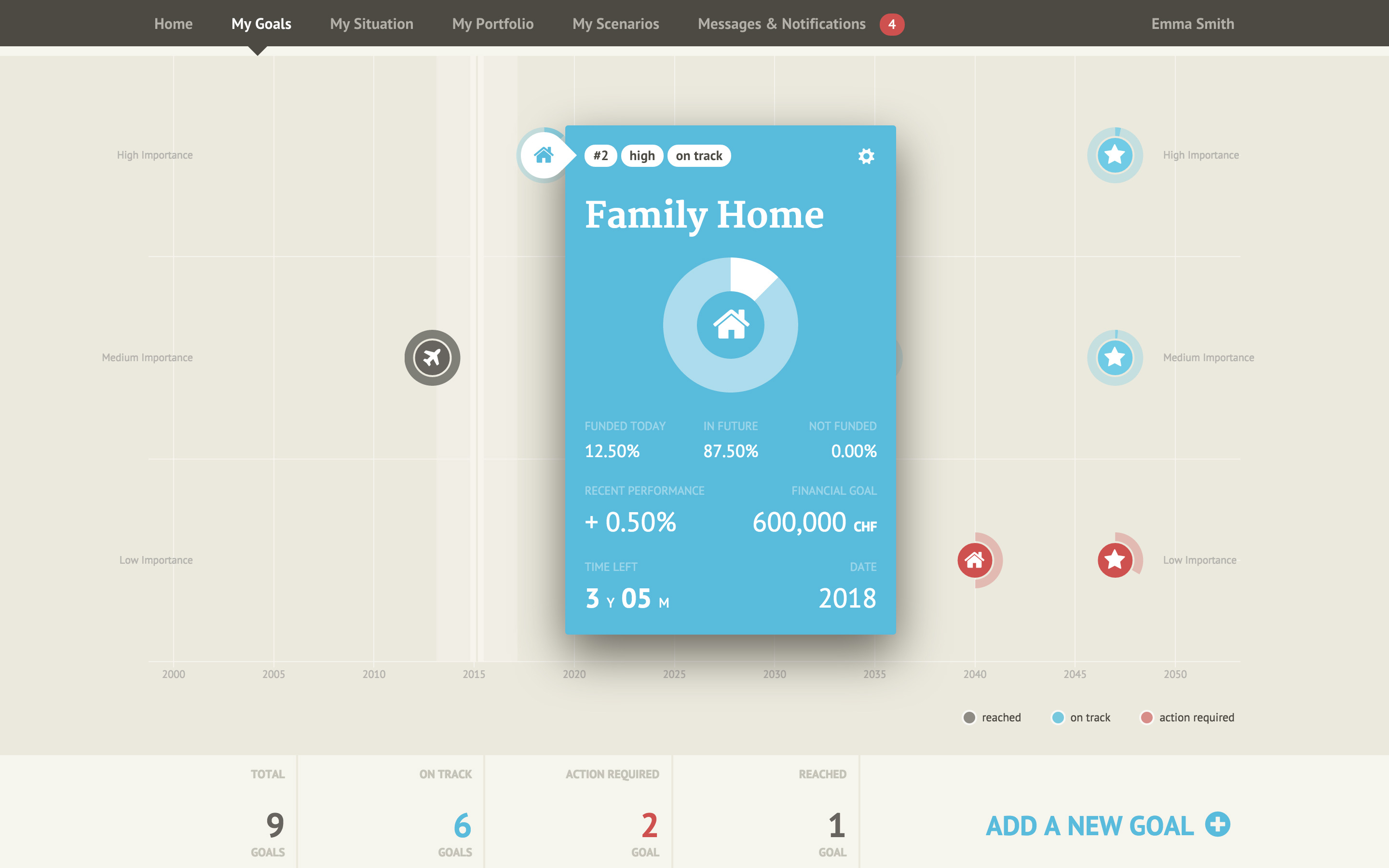

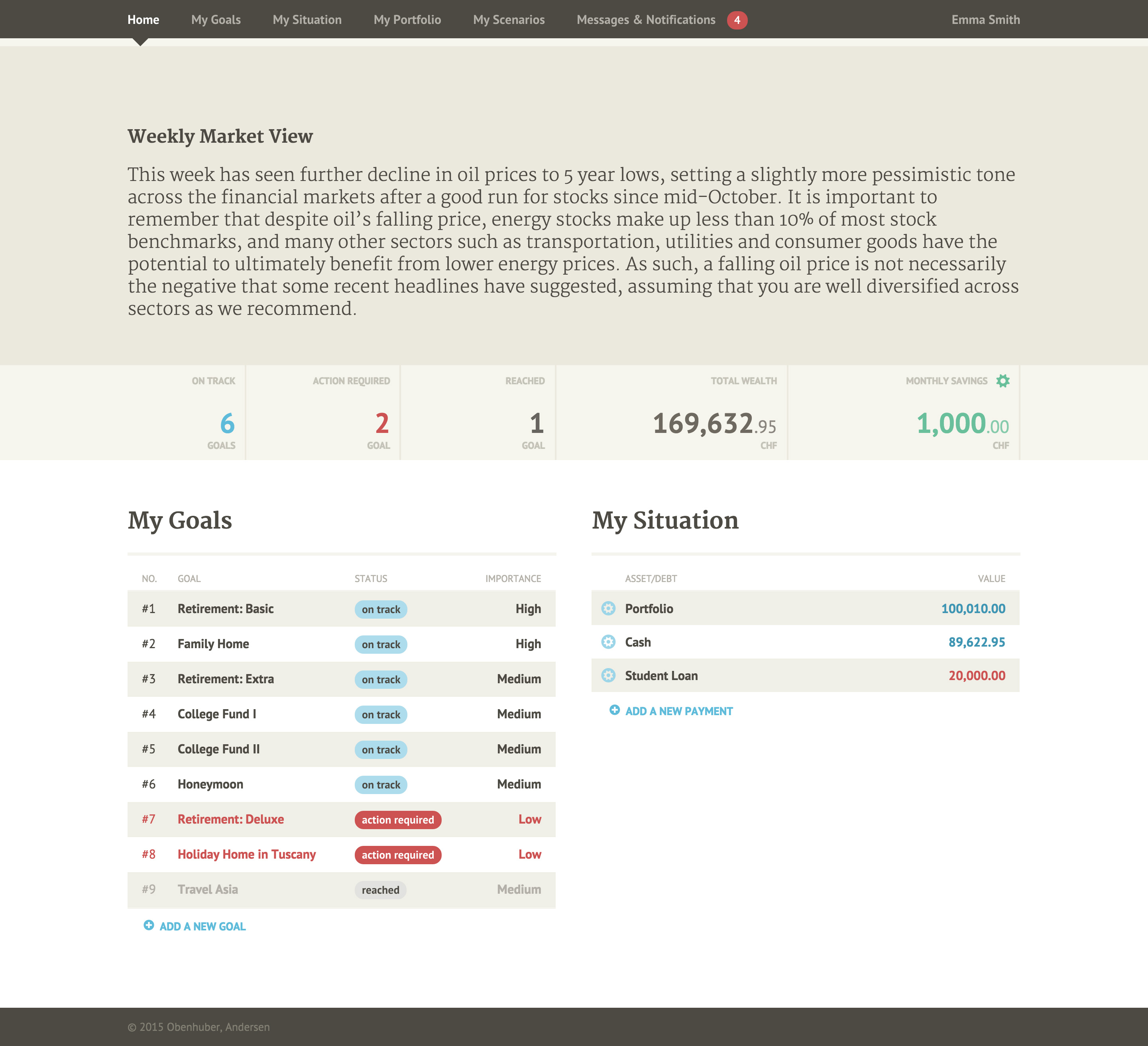

Individual investment advice: Offer investment advice that is tailored to clients’ financial situations and goals.

Capital market expectations: Reflect capital market expectations in customer portfolios.

Easy Integration: A secure API allows easy integration into existing systems.

Customisable: The flexible Financial Life Goals (FLG) investment engine can be adapted to specific commercial and customer needs.

- Overview

- Applications

- Endpoints

The wealth management industry is changing, with clients increasingly seeking holistic investment advice that takes into account their needs and individual situations.

FINANCIAL LIFE GOALS covers this requirement for all customer segments. Its advanced investment engine for portfolio optimisation and targeted financial planning, is easily accessible via an API for banks and asset managers and can be integrated quickly into existing solutions. The FINANCIAL LIFE GOALS API provides functionalities for consumer, client advisor and investment applications (Chief Investment Office).

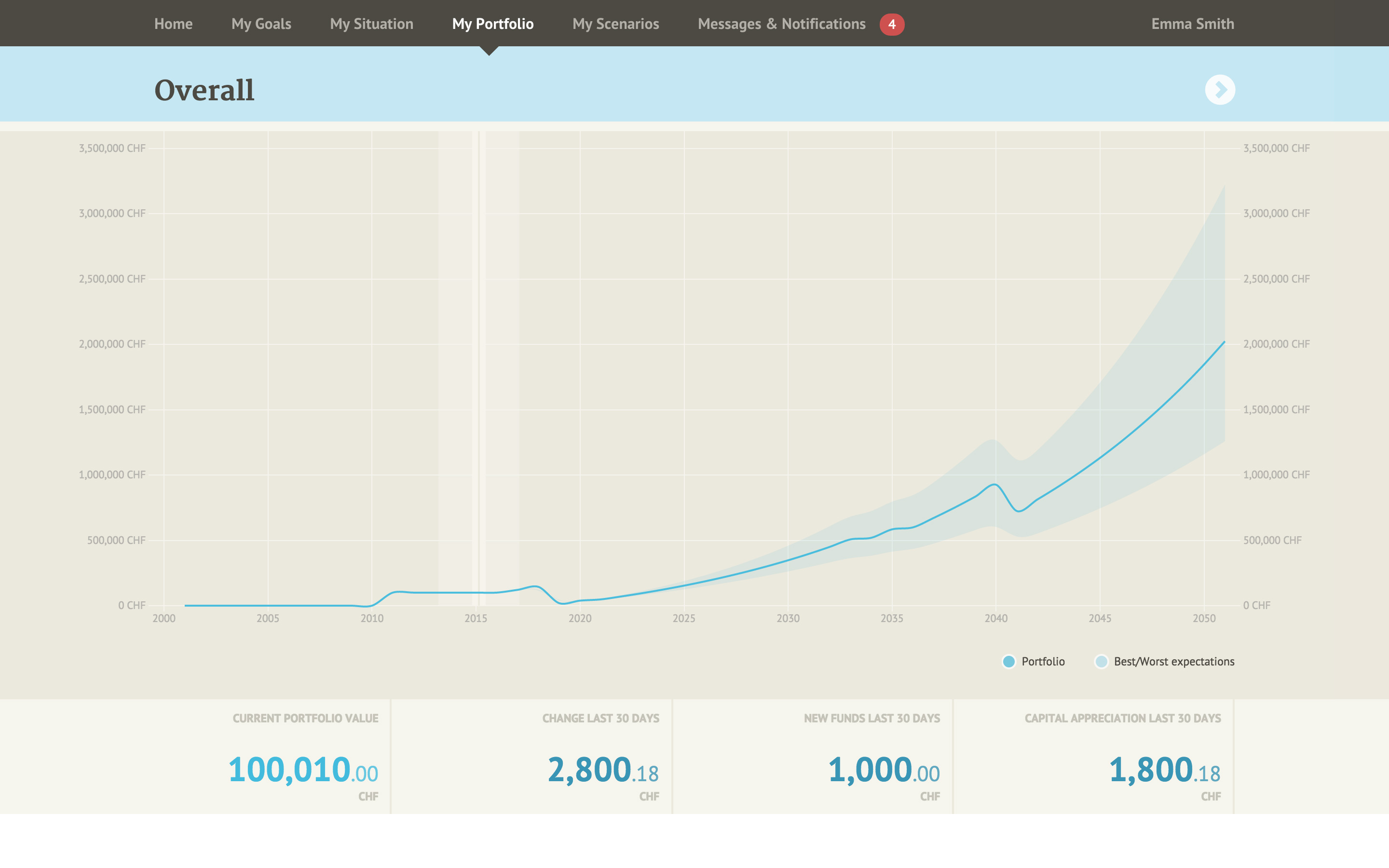

- Targeted investments maximise the likelihood of achieving financial goals within certain risk limits

- Robust, diversified portfolios are built using advanced optimisation algorithms that account for predictive expectations and historical probability distributions.

- Dynamic Asset Allocation optimally reduces portfolio risk up to the target date.

- Holistic assessment of personal financial situation including assets, liabilities, future savings potential and personal preferences.

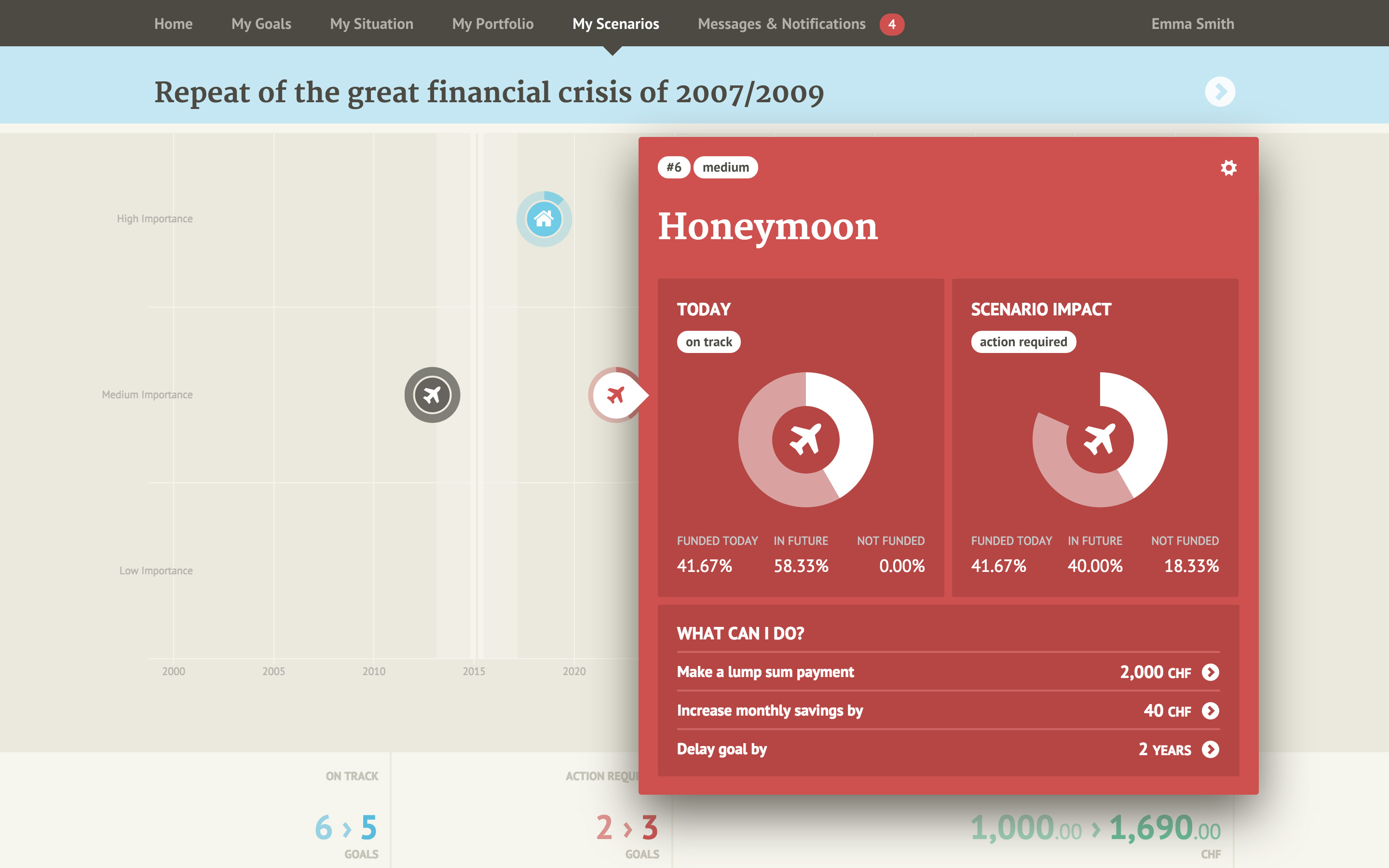

- Scenario analysis showing the impact of life and financial market scenarios on the likelihood of target achievement and the options for closing funding gaps.

FINANCIAL LIFE GOALS uses a REST API to make the investment engine accessible through various web services. The Django REST framework is used to provide easy and secure access to the API. All functionalities are developed by SWISS FIN LAB using Python.

The authentication takes place via a combination of Username and API Key (in the Request Header). Incoming requests are made via the secure HTTPS protocol and first validated accordingly. Most queries consist of POST HTTPS methods and simple GET HTTPS methods. The media type for all requests is an application / json standard format.

API hosting is by RobHost in Frankfurt / Main (DE), using the company’s own managed server based on nginx. The data centre operates to ISO 27001: 2013 certification and ISAE 3402 for the secure storage and processing of data. The data centre provides 24/7 availability and complies with relevant industry security standards.

The FINANCIAL LIFE GOALS API consists of several modules with respective functions. The individual modules can be used independently or simply combined with each other.

Goal Investing

Functions for calculating the optimal, dynamic asset distribution, target attainability indicators and scenario analysis include.

- GET_GLIDE_PATH

- GET_OPTIMAL_ALLOCATION

- GET_INITIAL_CAPITAL

- GET_FUNDED_STATUS

- GET_SHORTFALL_RISK

- ADJUST_FUNDED_STATUS_PAYMENT

- GET_ACCUMULATED_FUTURE_SAVINGS

- GET_BREAKEVEN_DATE

- GET_MAXIMAL_REGULAR_SPENDINGS

- GET_EXPECTED_CASH_FLOW_EVOLUTION

- GET_EXPECTED_PORTFOLIO_EVOLUTION

- GET_EXPECTED_TOTAL_WEALTH_EVOLUTION

- GET_PV_CASH_FLOW_PATH

- GET_SCENARIOS

- GET_UNCERTAIN_CASH_FLOW_PATH

Portfolio Analytics

Functions for portfolio optimisation and analysis.

- GET_CUMULATIVE_RETURN

- GET_EXPECTED_RETURN

- GET_MAXIMAL_RETURN_OPTIMAL_PORTFOLIO

- GET_MEAN_VARIANCE_OPTIMAL_PORTFOLIO

- GET_OPTIMAL_PORTFOLIOS

- GET_RETURN

- GET_RISK_TERM

- GET_RISK_TERM_FROM_CMA

Capital Market Assumption

Functions for generating capital market assumptions (cma).

- SIMULATE_RETURNS

Constraints

Functions that can be used to set constraints for portfolio optimisation.

- ADD_CONSTRAINTS

Data

- Customer goals and description of the financial situation. The FLG API does not require customer identification data and can be used completely generically.

- Capital market data to describe expected return and risk for each asset class; assumption of return distribution and correlation structure; information on maturity structure of interest rates and inflation.

- Reference portfolios (optional): The FLG API can perform dynamic asset allocation optimizations based on existing reference portfolios.

About the provider

SWISS FIN LAB GmbH develops innovative solutions in the field of FinTech and LegalTech. The team consists of financial market experts from the private banking sector, quantitative analysts and application developers. Its vision is to provide sophisticated and individualised investment advice – which in the past was only accessible to private banking clients – to a broad segment through a modern API. To achieve this, it uses advanced methods for portfolio optimisation and data analysis.

SWISS FIN LAB also offers consulting services in the area of portfolio optimisation, strategic and tactical asset allocation and the use of machine learning in the investment process. In addition, it develops independent applications based on the FINANCIAL LIFE GOALS API.

SWISS FIN LAB GmbH was founded in 2016, and is based in Zurich, Switzerland, with an additional office in Vienna.