Market coverage

- Austria

- Germany

- Switzerland

Optimization of sales activities through personalized offers and recommendation

New insights into customer behavior and business development

Increased customer satisfaction, trust and loyalty

Customer approval for further data processing

- Overview

- Applications

- Endpoints

With the power of AI and Machine Learning, Contovista turns payment information into valuable assets and insights for consulting, sales, marketing and in-house analytics teams.

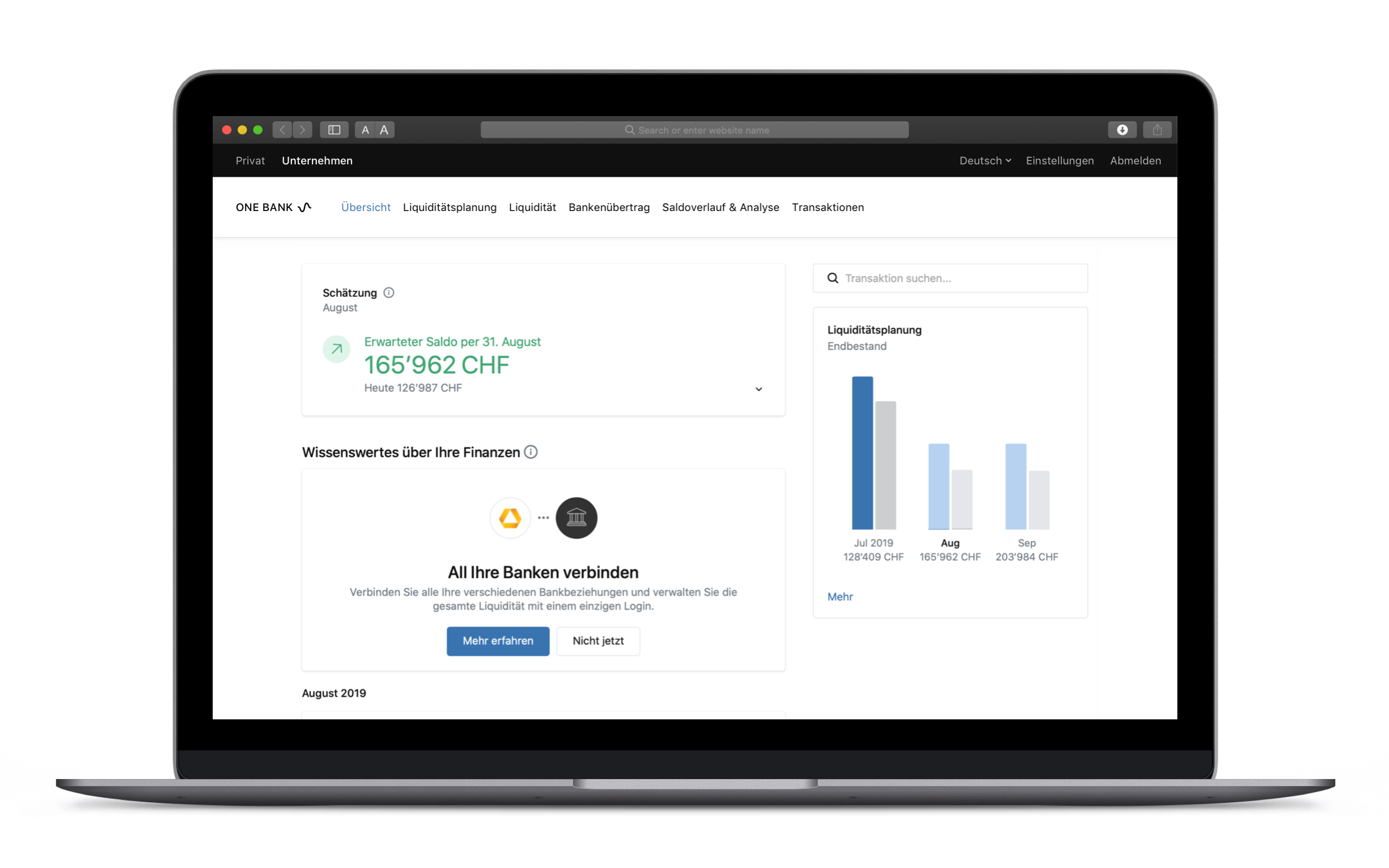

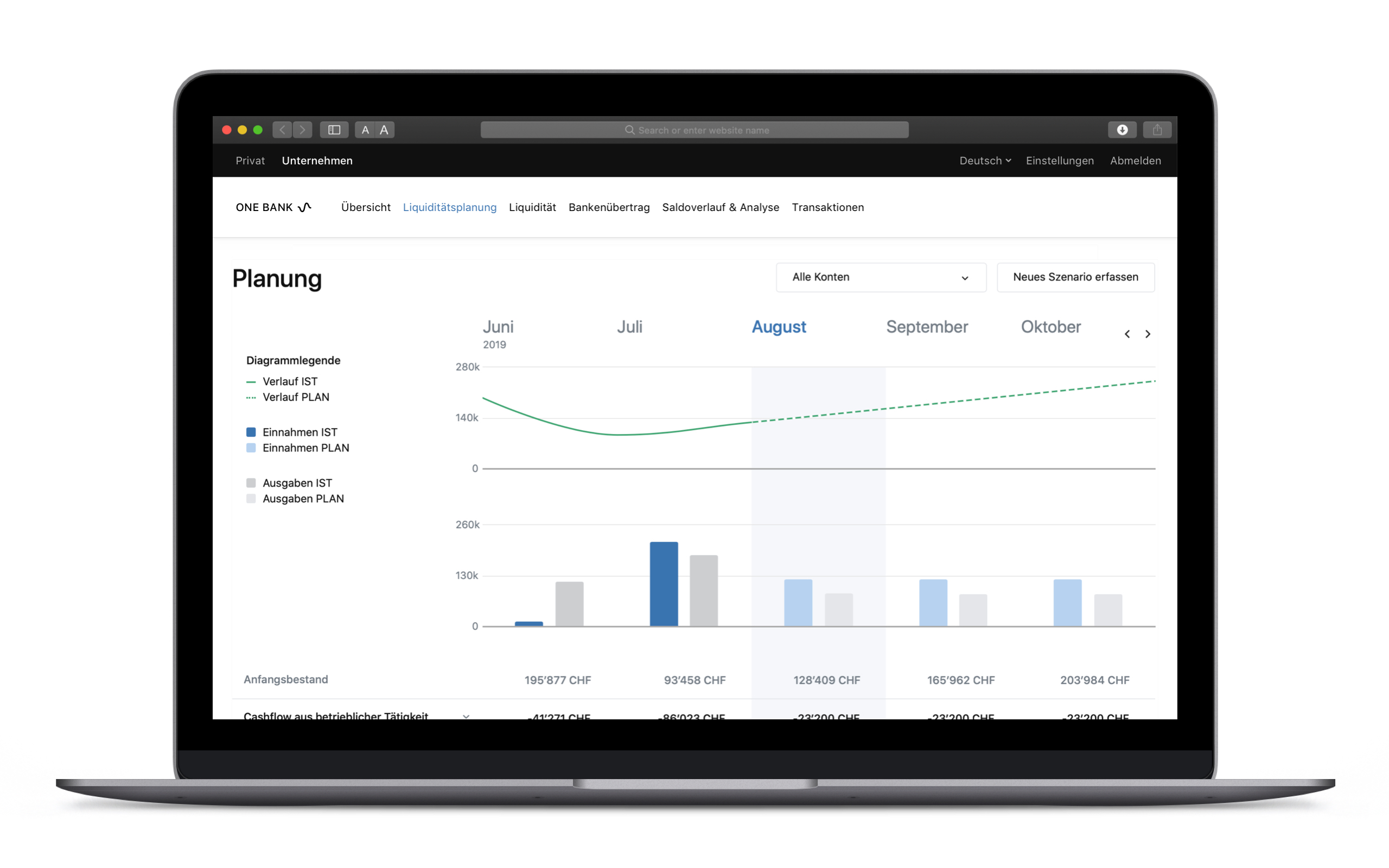

Contovista’s Business Finance Manager serves in particular for simple and effective liquidity planning. All cashflows are automatically categorized, analyzed and evaluated with regards to future developments. Based on structured data, app users can create forward-looking and highly personalized recommendations and offer tailor-made products.

Contovista’s Business Finance Manager provides your customers with the following functions:

- Simple, intuitive financial management integrated into e-banking or client portal

- Optimized liquidity planning through information supported by Data Analytics & Machine Learning

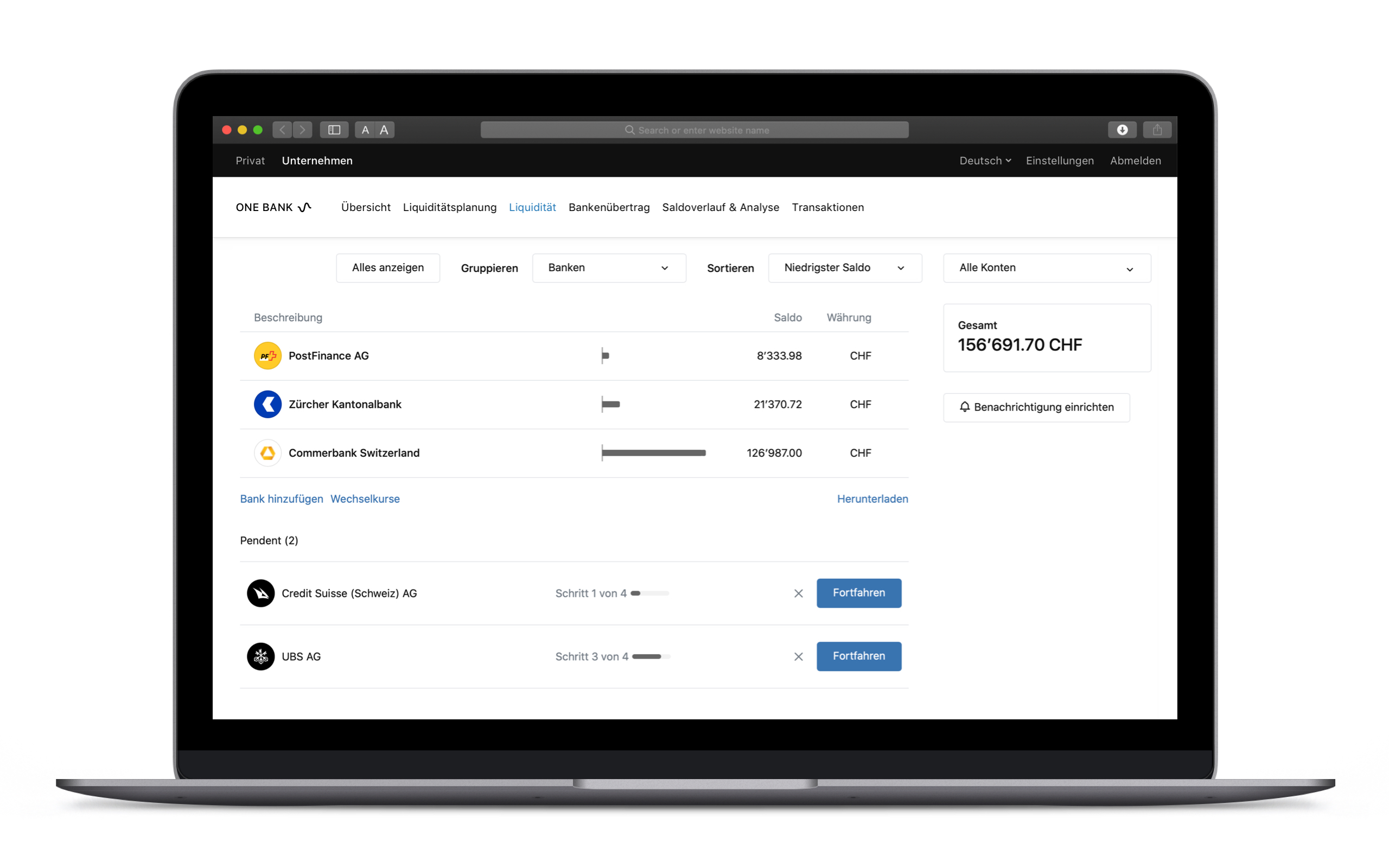

- Access to the account information of all banks

- Time savings for more focus on the core business

Accelerate innovation using Contovista’s powerful and flexible API to integrate analytics solutions into existing ecosystems quickly and easily.

The flexible white label software ensures a seamless integration of the Business Finance Manager into your existing Customer Journey and CD/CI.

Benefit from outstanding data quality, thanks to central enrichment of insensitive data.

Use the Business Finance Manager to integrate third-party bank data via PSD2 or other interfaces. Turn the Business Finance Manager into the central financial cockpit by integrating accounting or invoicing software in addition to third-party bank data.

The Enrichment Engine and Analytics are based on transaction data from various sources:

- PSD2 Aggregators

- Core banking systems

- Data warehouse provider

- Credit card issuer

This transaction data is cleansed and enriched with a multitude of meta data.

About the provider

Contovista enables data-driven banking.

Launched in 2013 as a fintech pioneer, Contovista is now Switzerland’s market leader for data-based banking.

Contovista’s white-label software, data and analytics solutions integrate smoothly into existing banking systems, allowing banks and financial institutions to optimize the customer experience across their digital channels.

With data enhancement and machine learning, Contovista helps banks and financial service providers to better understand customers, to better advise them and to make banking more personal. As a result, inspiring increased customer loyalty and share-of-wallet.

The company, reaches more than 5 million customers through its partner banks. Contovista is headquartered in Zurich, Switzerland.