Market coverage

- Austria

- Germany

- Switzerland

New insights into customer behaviour

Increased customer satisfaction, trust and loyalty

Increase of traffic and residence time on the digital channels

Simplified marketing and analytics approval for your customers

Improve sales performance through personalized cross-selling and information about third-party bank products

- Overview

- Applications

- Endpoints

With the power of AI and Machine Learning, Contovista turns payment information into valuable assets and insights for consulting, sales, marketing and in-house analytics teams.

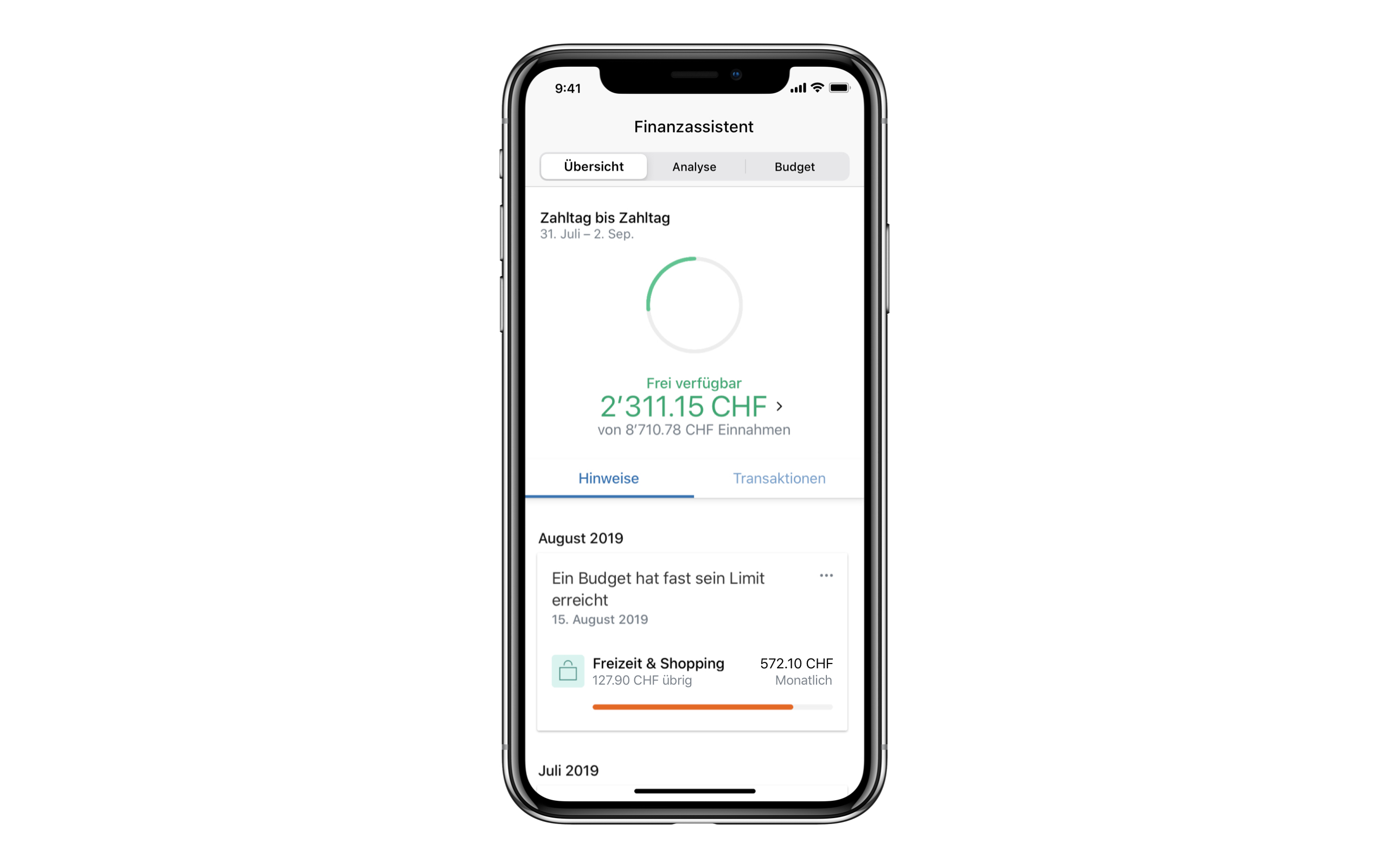

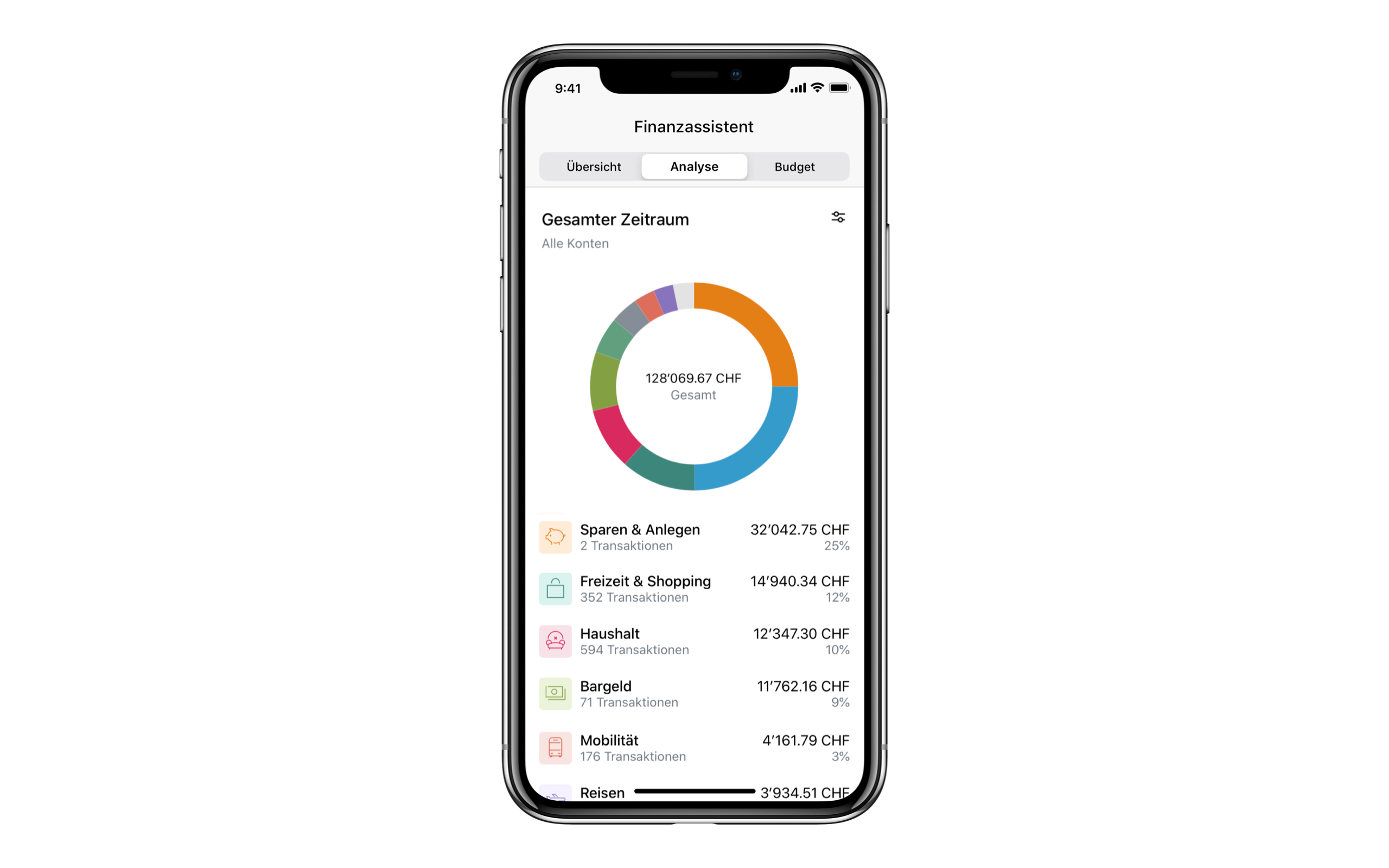

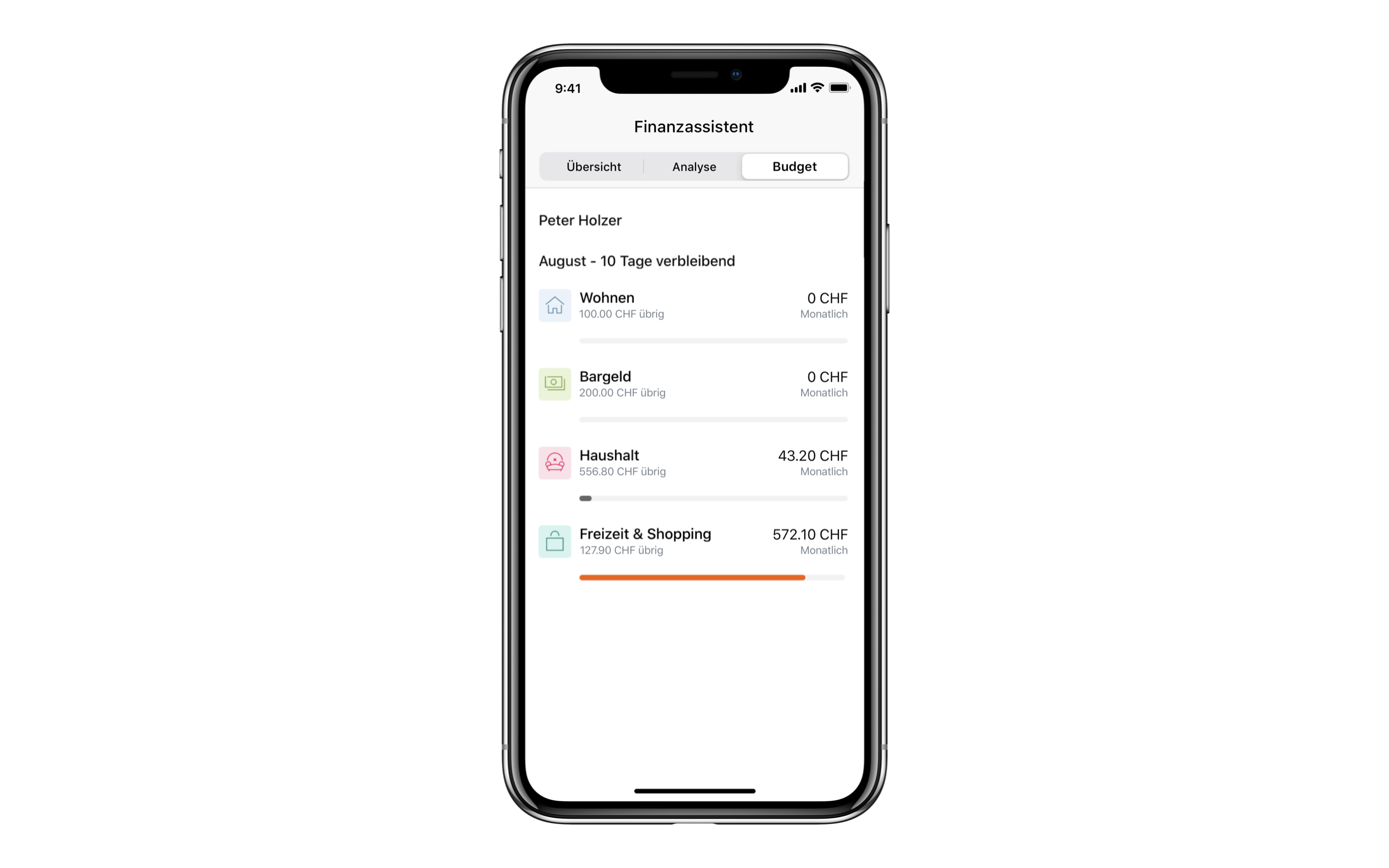

In the Personal Finance Manager, all income and expenses of your private customers are analyzed, categorized and clearly displayed in the e-banking or customer portal. It visualizes optimization approaches and supports personal financial planning. Relevant financial information, also from third-party banks, and personalized coachings are available as well – when and where your customers want them, collected in one place.

Contovista’s Personal Finance Manager offers your customers the following functions:

- Overview of all transactions from all aggregated accounts

- Semantic search across all transactions

- Overview of available budgets, based on fixed and forecasted incomes and expenses, until end of month

- Notes regarding unusual transactions and useful financial tips directly in the timeline

- Defining budgets and saving targets

- Visualized statistics on income and expenses

Accelerate innovation using Contovista’s powerful and flexible API to integrate analytics solutions into existing ecosystems quickly and easily.

The flexible white label software ensures a seamless integration of the Personal Finance Manager into your existing Customer Journey and CD/CI.

Benefit from outstanding data quality, thanks to central enrichment of insensitive data.

Data Enrichment and Analytic are based on transaction data from different sources:

- PSD 2 aggregators

- Core banking systems

- Data warehouse providers

- Credit card issuers

Transaction data is cleaned up and enriched with a variety of meta-data.

Furthermore, Contovista’s proven algorithms identify customer-related events and characteristics, e.g.

- Budget calculation as basis for credit decisions

- Recurring payments

- Fixed vs. variable costs

- Third-party bank relationships

- KYC-related information (e.g. change of employer)

- Irregularities in payment behavior (e.g. unusually high payments)

- Customer-related characteristics (e.g. Frequent Traveller, tenant vs. homeowner etc.)

About the provider

Contovista enables data-driven banking.

Launched in 2013 as a fintech pioneer, Contovista is now Switzerland’s market leader for data-based banking.

Contovista’s white-label software, data and analytics solutions integrate smoothly into existing banking systems, allowing banks and financial institutions to optimize the customer experience across their digital channels.

With data enhancement and machine learning, Contovista helps banks and financial service providers to better understand customers, to better advise them and to make banking more personal. As a result, inspiring increased customer loyalty and share-of-wallet.

The company, reaches more than 5 million customers through its partner banks. Contovista is headquartered in Zurich, Switzerland.