Market coverage

- Austria

- France

- Germany

- Spain

- Switzerland

XS2A data via various channels: Direct access via FinTecSystems’ own bank interfaces (API), bank interfaces of other TPPs or via upload of standard bank formats such as MT940.

Scientific analysis and categorization of account transactions

Creation of individual reports according to the modular design

Enables real-time credit decisions, creditworthiness checks, creation of a budget account

Plug & Play solution without long deployment time

- Overview

- Applications

- Endpoints

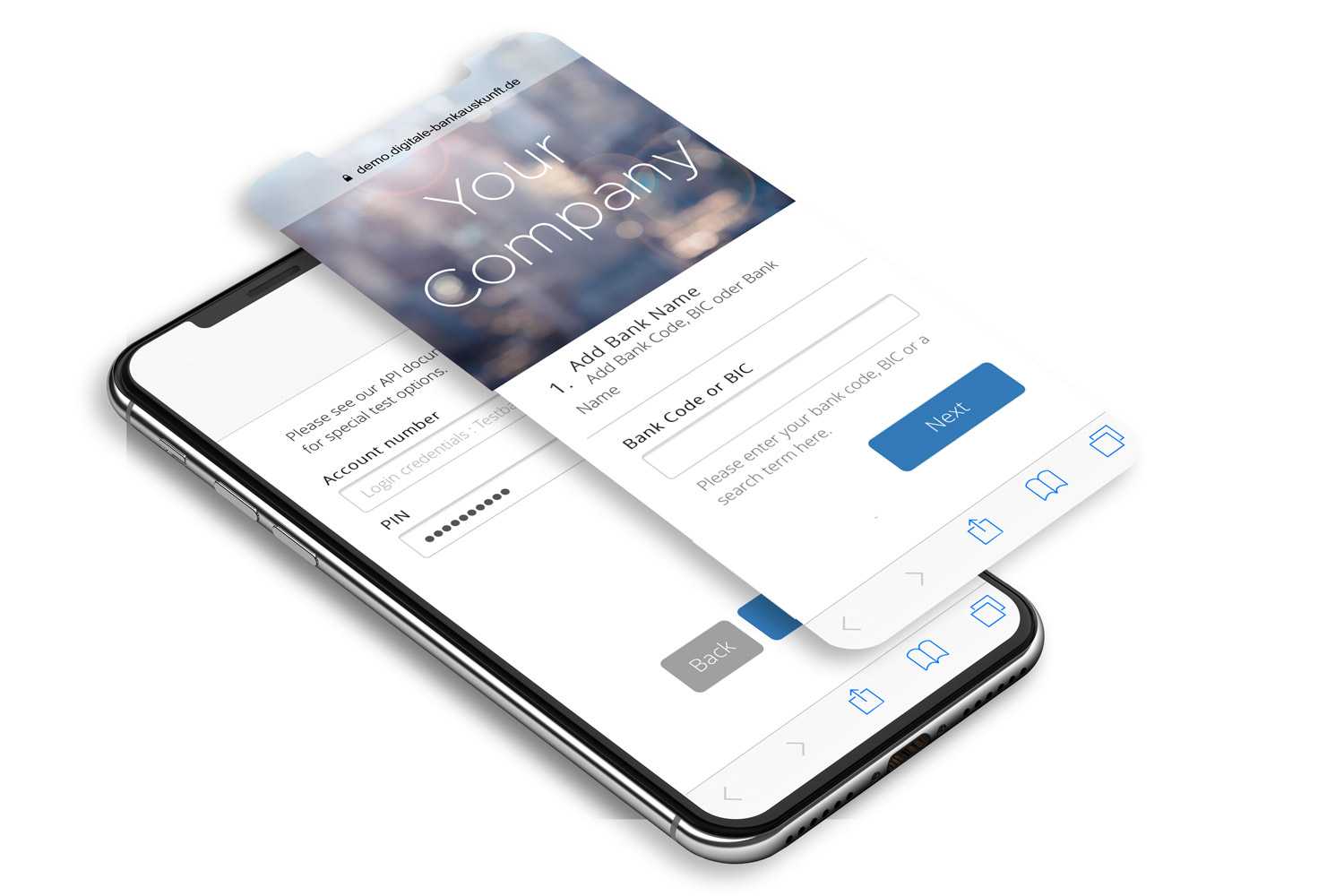

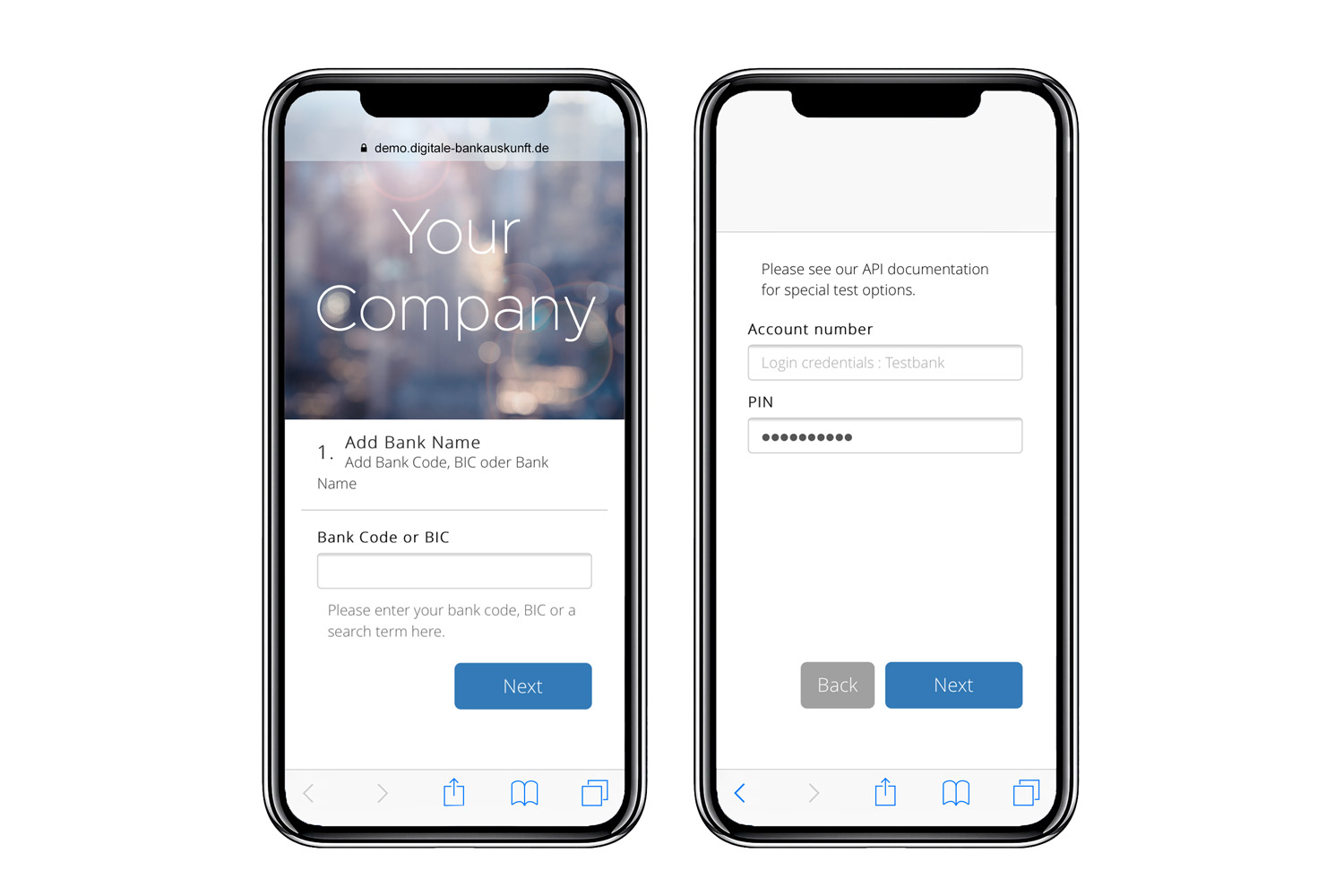

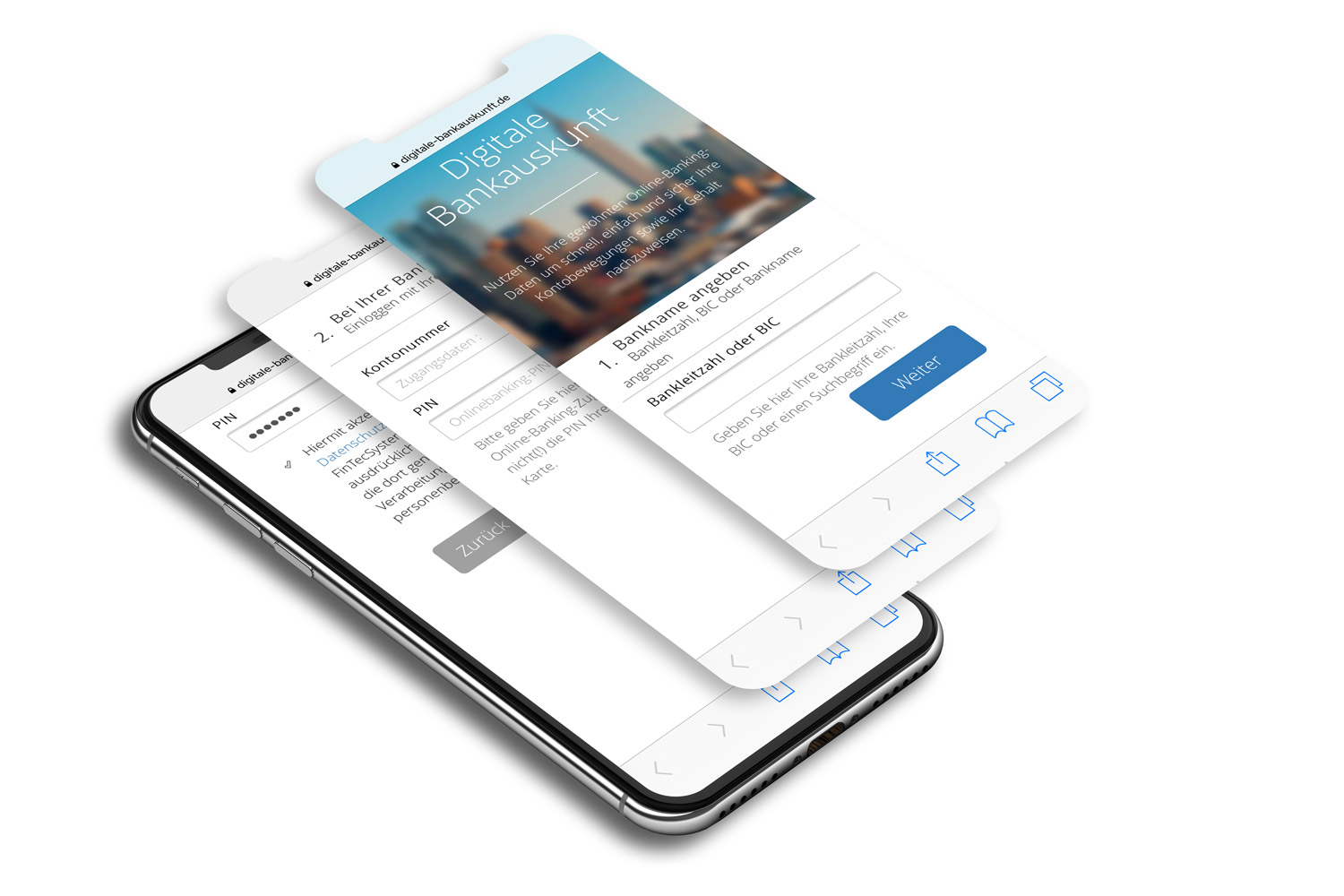

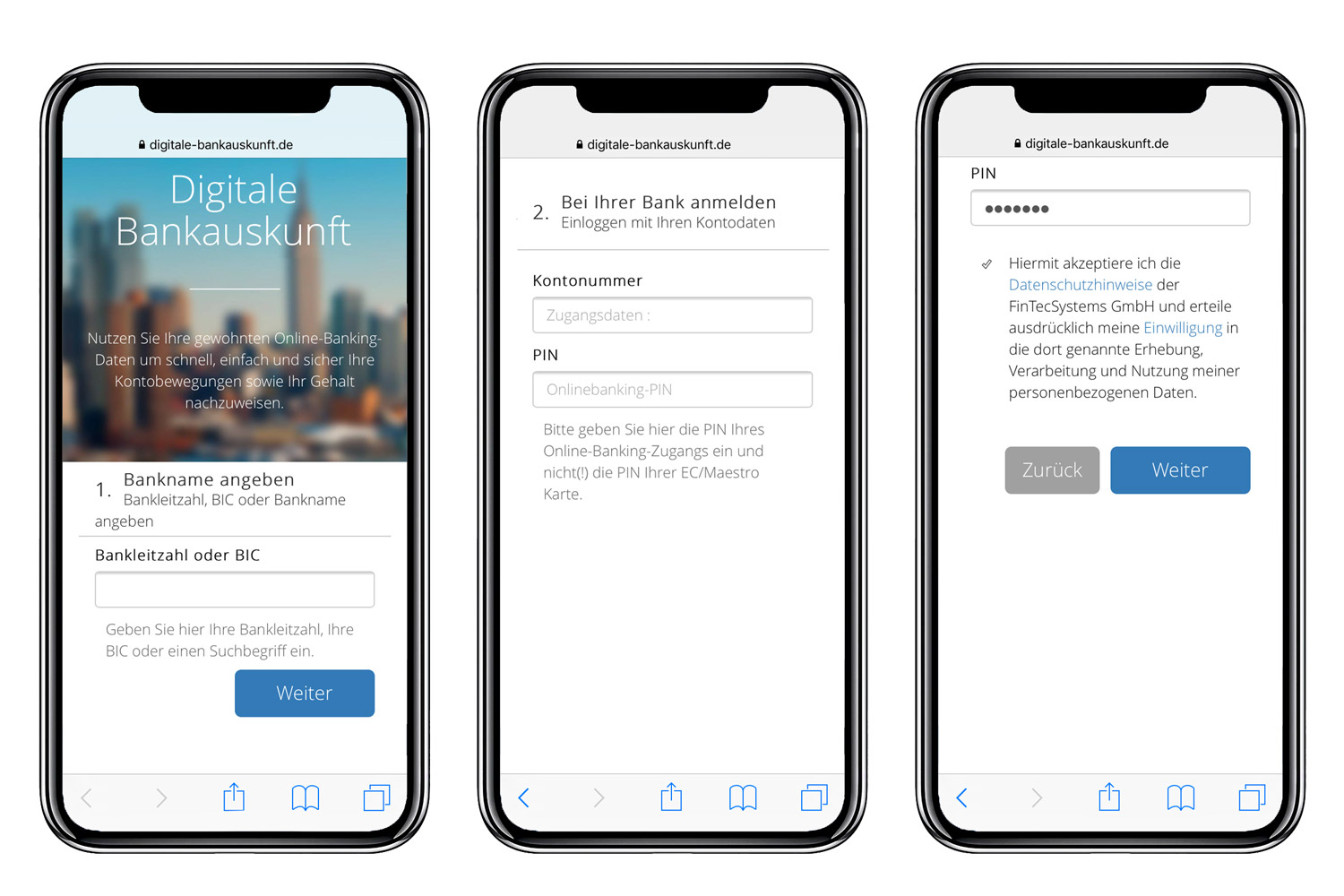

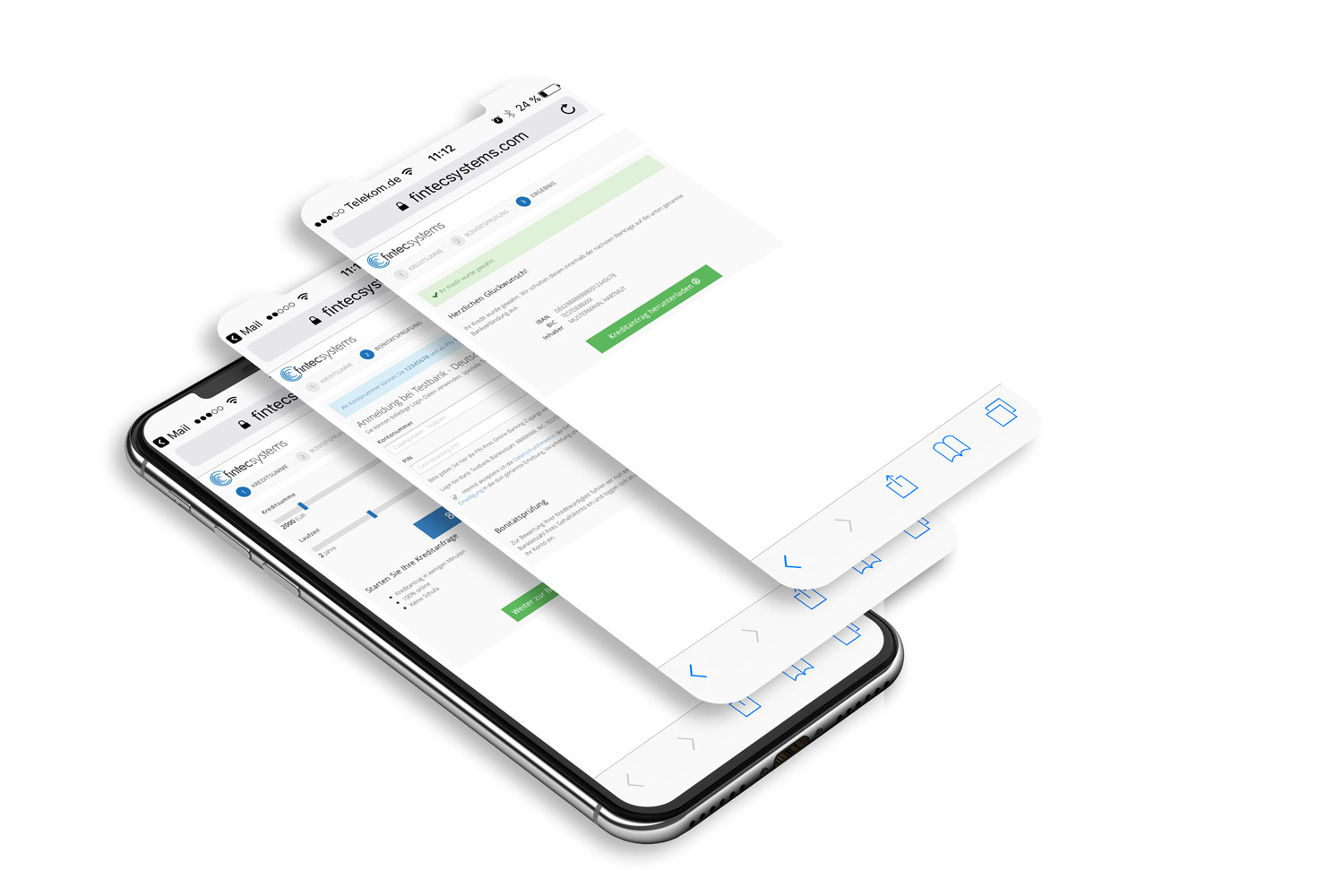

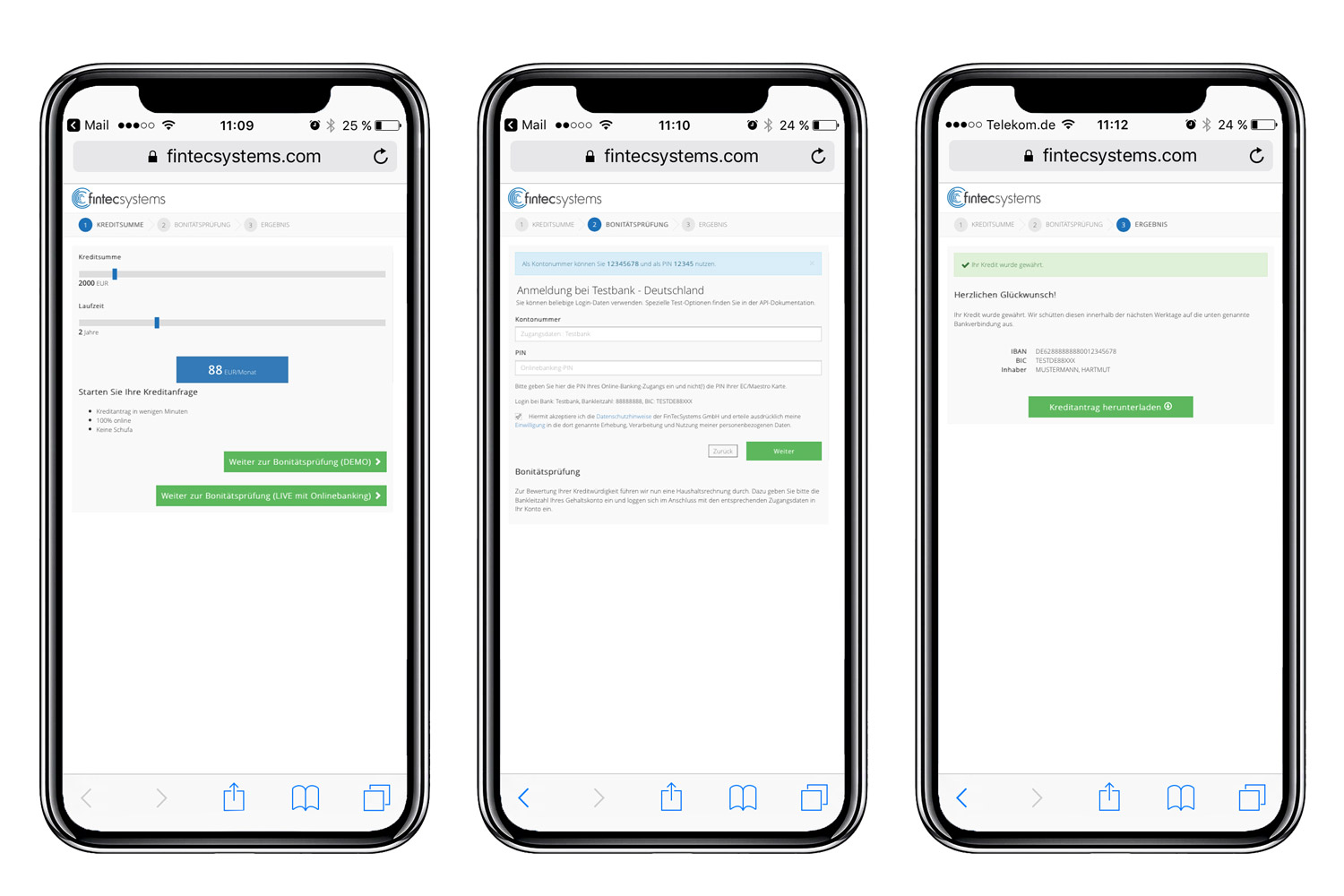

The FinTecSystems XS2A.RISK interface provides one-time access to the account data of a bank account in order to obtain an electronic account statement or to retrieve specific analysis results (individual key figures such as risk characteristics or entire reports) via a selection of predefined analysis modules from the FinTecSystems Analytics Platform. The initial call by the provider specifies the scope of analysis to be performed on the data of the online banking account. The customer is then prompted to interact (login to online banking). After the successful login and, if necessary, the account selection (reference account) by the customer, the desired results are made available to the provider for retrieval.

FinTecSystems provides white-label account information and payment services with the same look and feel of its clients’ brands. The self-developed online banking-based API enables companies to aggregate and analyse financial data and make decisions in real time. For example, its products accelerate loan commitments, minimise counterparty risk, and categorise real-time sales data to make them more meaningful. FinTecSystems is also licensed by BaFin.

Under PSD2, the issue of retrieval of account information and payment triggers is increasing in importance as it provides a standard which promotes the receipt of bank-independent financial data.

The FinTecSystems’ solution is highly customer-centric. Only after online log-in and authentication is financial data collected, prepared and provided within meaningful categories. Its digital process helps clients avoid disruption and accelerates applications. In addition, it improves their processes in line with PSD2 and meets BaFin requirements without them having to own the application process.

Main functions:

- one-time access to account data of a bank account

- one-time access to the online transfer function of a bank account

- creation of individual reports according to the modular design

FinTecSystems’ online banking-based API delivers a process that is simple for its clients and their users. Seamless integration ensures a consistent client look and feel and a familiar environment for users. After successful customer login, the consumer’s account information is determined and then made available in a prepared form. This data can be used for decision making and further process selection enabling customers to use the tool to digitise and optimise their own processes.

Hosting is exclusively with FinTecSystems and processing takes place in a German-based data centre certified according to ISO27001. All transmitted data is SSL-encrypted and subject to a double-encrypted access code. FinTecSystems operates according to the strict German Federal Data Protection Act and the EU Data Protection Act (DS-GVO). Availability is agreed via appropriate SLAs and financial data is deleted by default after 30 days.

Bankcodes API

Checks if the selected bank is supported by the XS2A interface and returns a paginated list of all bank objects.

- GET_bankcodes

- GET_bankcodes_all

- POST_bankcodes_autocomplete

Events API

Returns all events and downloads a special event for a transaction object.

- GET_events

- GET_events_events-id

XS2A.RISK

Returns a list of all XS2A.RISK transaction objects and all events for a XS2A.RISK transaction object. It also downloads an account snapshot and an information sheet.

- GET_risks

- POST_risks

- DELETE_risks_transaction-id

- GET_risks_transaction-id

- GET_risks_transaction-id_accountSnapshot

- GET_risks_transaction-id_events

- GET_risks_transaction-id__factSheet

Sessions API

Sends a wizard_session object

- GET_sessions_transactions-id

Versioning & Compatibility

Wizard API

Navigation through the wizard.

- POST_wizard

About the provider

FinTecSystems is one of the leading banking API and smart data providers in Germany, Austria and Switzerland. In addition to an Open Banking Platform, which provides account information and payment initiation services, FinTecSystems has an analytics platform that focuses on analysing and categorising financial data for banks, fintech and payment service providers. Its solutions are used to aggregate account data in real time, make credit decisions, minimise credit risks and initiate online transfers.

TÜV-certified, FinTecSystems works for N26, Santander, DKB and Deutsche Handelsbank, among others. Since 1 March 2019, FinTecSystems has been a regulated institution under the Payment Services Supervision Act (ZAG) and has been granted permission by BaFin as a payment initiation and account information service.